The 45-Second Trick For Mortgage Broker Job Description

Wiki Article

Mortgage Broker Assistant Can Be Fun For Everyone

Table of ContentsThe 8-Minute Rule for Broker Mortgage CalculatorThe Broker Mortgage Near Me DiariesOur Broker Mortgage Meaning DiariesThe Greatest Guide To Mortgage Broker Job DescriptionThe Single Strategy To Use For Mortgage Broker Average Salary10 Easy Facts About Broker Mortgage Near Me DescribedHow Broker Mortgage Rates can Save You Time, Stress, and Money.Some Known Questions About Mortgage Brokerage.

A broker can contrast finances from a financial institution and also a credit history union. According to , her first obligation is to the organization, to make sure finances are correctly safeguarded as well as the borrower is completely qualified as well as will make the financing payments.Broker Payment A mortgage broker represents the debtor extra than the lender. His responsibility is to get the customer the finest offer feasible, no matter the institution. He is typically paid by the financing, a type of payment, the difference between the rate he receives from the borrowing institution and the price he offers to the consumer.

Some Of Mortgage Broker Job Description

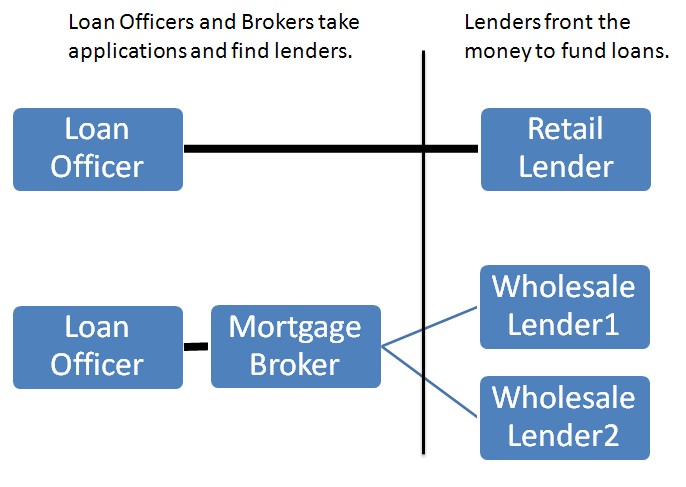

Jobs Defined Recognizing the benefits and drawbacks of each could aid you choose which career course you want to take. According to, the primary distinction in between both is that the financial institution home mortgage officer stands for the items that the financial institution they benefit offers, while a mortgage broker works with numerous loan providers and serves as a middleman in between the lenders and customer.On the other hand, financial institution brokers might find the task ordinary eventually given that the process typically continues to be the same.

A Biased View of Broker Mortgage Fees

What Is a Financing Officer? You might recognize that finding a financing policeman is a vital action in the procedure of acquiring your loan. Let's review what loan police officers do, what knowledge they require to do their work well, as well as whether financing police officers are the very best choice for borrowers in the lending application screening procedure.

The Only Guide to Mortgage Broker

What a Car loan Officer Does, A financing policeman helps a bank or independent lender to assist debtors in making an application for a car loan. Because lots of consumers function with funding officers for mortgages, they are often described as home loan officers, however several lending policemans help customers with various other fundings as well.If a finance policeman believes you're qualified, then they'll suggest you why not try this out for authorization, and you'll be able to proceed on in the procedure of acquiring your financing. What Funding Policemans Know, Loan police officers should be able to function with consumers and little service owners, and also they should have substantial knowledge regarding the sector.

About Broker Mortgage Near Me

4. Just How Much a Loan Policeman Expenses, Some finance police officers are paid using compensations. Mortgage tend to lead to the largest commissions due to the dimension and work connected with the financing, yet compensations are commonly a flexible pre paid cost. With all a funding police officer can do for you, they often tend to be well worth see here now the cost.Financing police officers know all concerning the lots of kinds of finances a lender might offer, and they can provide you advice regarding the finest choice for you as well as your scenario. Discuss your needs with your funding officer.

Mortgage Broker Job Description Can Be Fun For Anyone

The Role of a Car Loan Policeman in the Testing Refine, Your financing policeman is your direct get in touch with when you're applying for a financing. You won't have to worry regarding on a regular basis calling all the people included in the mortgage loan procedure, such as the expert, real estate representative, settlement lawyer and others, due to the fact that your financing officer will be the factor of get in touch with for all mortgage broker benefits of the entailed parties.Because the process of a financing purchase can be a facility and also pricey one, several consumers like to deal with a human being as opposed to a computer system. This is why financial institutions might have a number of branches they desire to serve the potential borrowers in different areas that wish to satisfy in person with a car loan policeman.

Broker Mortgage Near Me - The Facts

The Duty of a Lending Policeman in the Financing Application Process, The mortgage application process can feel overwhelming, specifically for the first-time property buyer. When you function with the right lending officer, the process is really quite basic.During the finance processing phase, your finance police officer will certainly contact you with any kind of questions the funding processors might have about your application. Your finance officer will certainly after that pass the application on the expert, who will evaluate your creditworthiness. If the underwriter approves your car loan, your funding policeman will certainly then collect and also prepare the ideal loan shutting papers.

Some Known Details About Mortgage Broker Average Salary

So just how do you select the appropriate finance officer for you? To start your search, begin with lending institutions who have a superb online reputation for exceeding their customers' expectations and also keeping market criteria. As soon as you have actually chosen a lender, you can then begin to tighten down your search by interviewing financing officers you may wish to function with (mortgage broker salary).

Report this wiki page